Key Accounting Principles v6.0

AME System Overview

The AME Learning System™ has an exclusive teaching approach that is proven to engage students. Intended to educate all managers in the business world, the AME Learning System has grown to include a fully rounded accounting courseware for higher education accounting courses.

Our system incorporates the best of cognitive science, modern technology, and proven learning principles into an active and practical learning approach that emphasizes constant decision-making, integrated real-world examples and impact over memorization.

Students work through interactive online tutorials and learn key accounting concepts before they arrive in class. Prepared students means classroom instructors can focus on the teaching and application of core concepts. Teachers hold the power in setting deadlines and milestones for all resources and tutorials to build a customized course that works for them, their curriculum, and their students.

Version 6.0 Overview

Key Accounting Principles V6.0 frames the study of accounting in a highly practical, fully integrated, and interactive learning experience.

Perfect for both accounting majors and non-majors accounting courses in any program (such as Office Admin, HR, Legal, Sports Management)

The AME approach starts with “personal accounting” early in the course so students can understand basic accounting logic and principles from a personal perspective before quickly moving on to applications in a business context.

The AME approach has been proven to significantly improve student engagement and grades with a substantial reduction in drop-out and failure rates.

Student Courseware

Version 6.0 Student Tutorials

Integrated seamlessly with our print and online textbooks, they will help flip your classroom and engage your students.

Test-drive two tutorials and experience them yourself!

Want to see more?

integrated seamlessly with our print and online courseware resources.

For Students

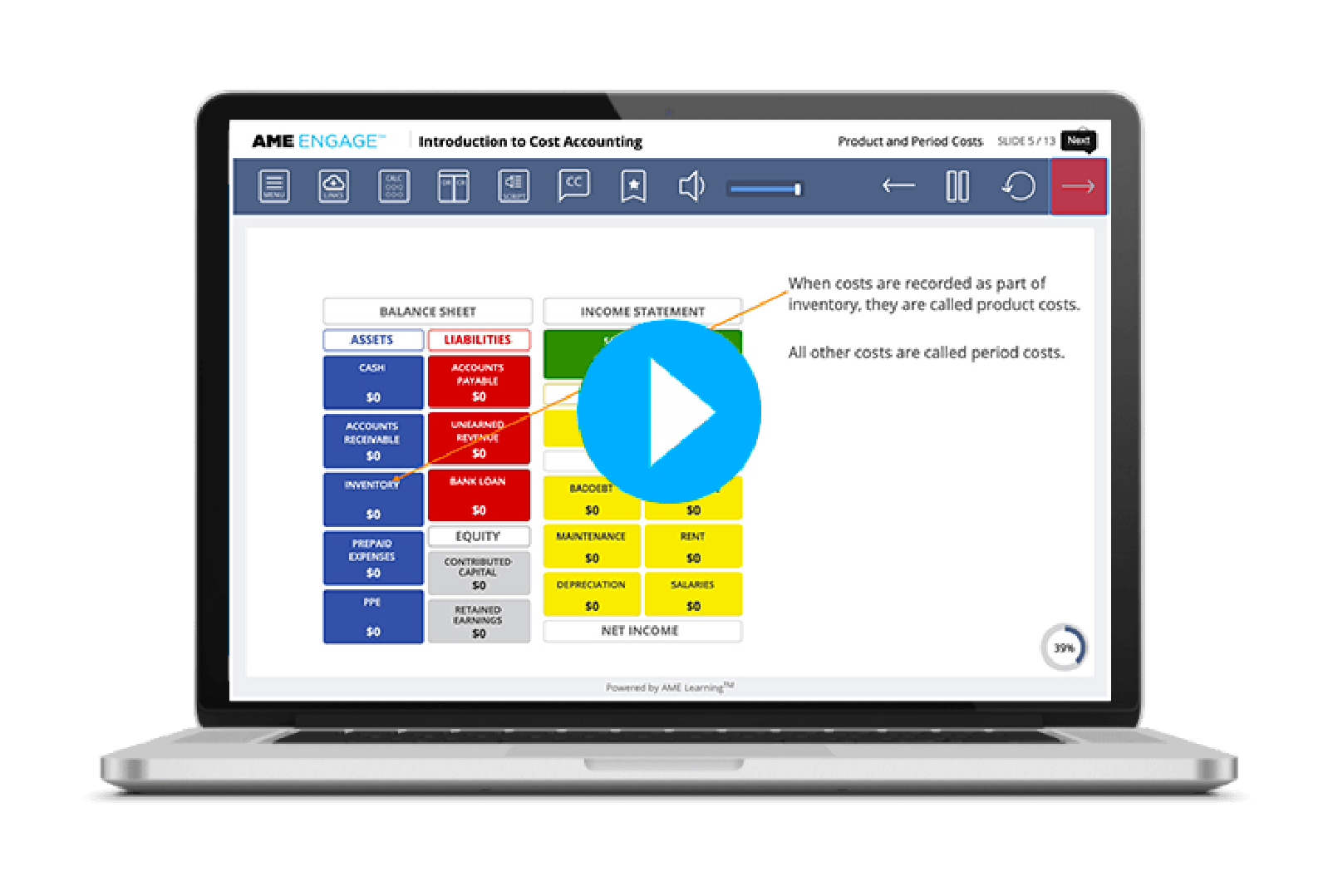

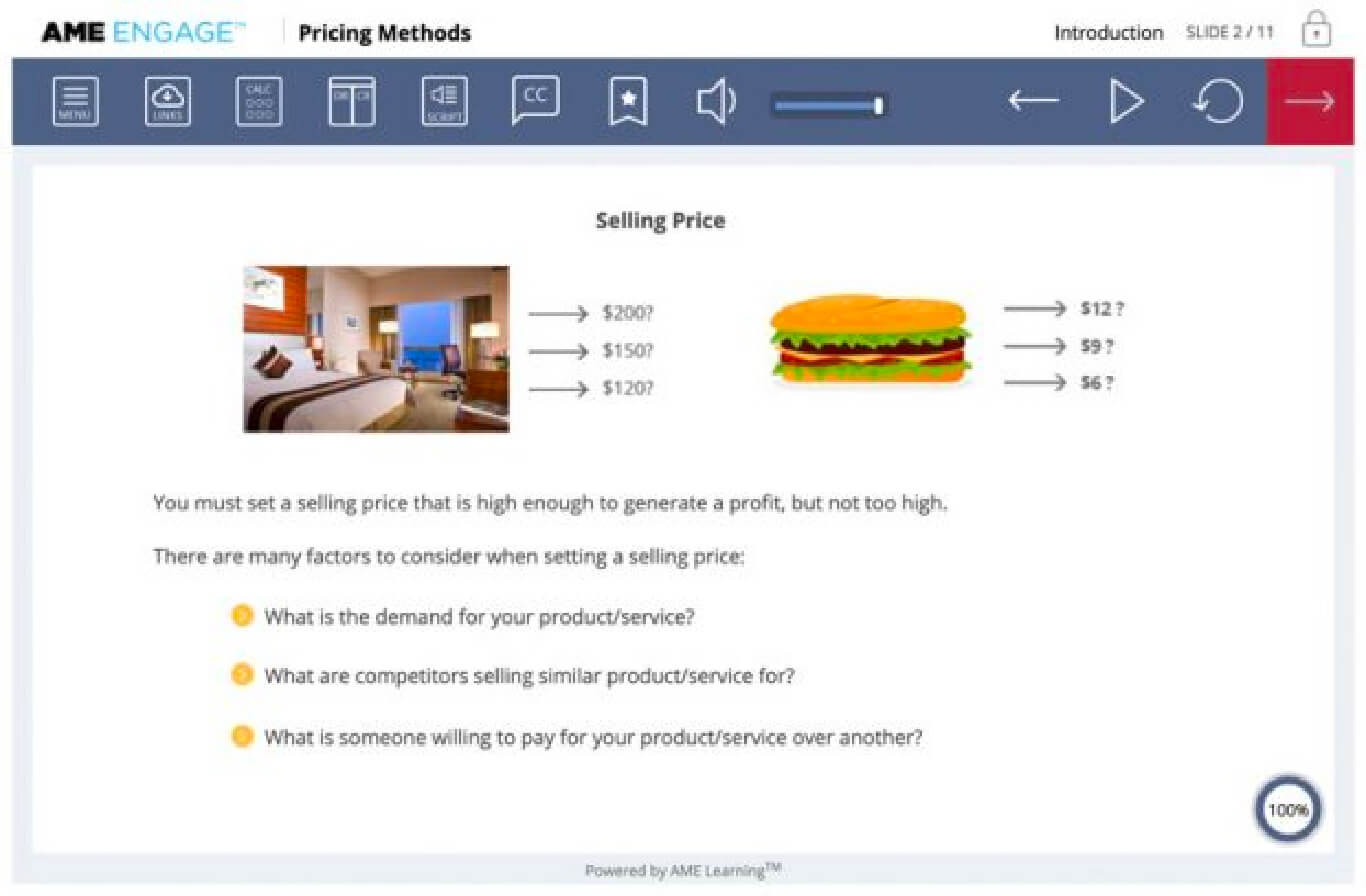

AME Engage™

AME Engage™ is an online, interactive component of the AME Learning System featuring the Accounting Map™, a digital and highly visual interactive balance sheet and income statement for powerful and practical transactional learning. Students will access Interactive Pre-Class Tutorials, Quizzes, and Post-Class Homework. Plus, a digital textbook and workbook allow students to quickly access homework related questions and subject matter.

For Instructors

AME Assistant™

Our AME Assistants act as your teaching assistant to help you create and curate your course and its materials. We customize experience, content, and your support because we know our customers personally. We ensure our technology is portable and interoperable with your platforms while organizing our materials to match your needs and processes, giving you more free time to focus on what matters most: your students!